The world of digital currencies can seem complex and intimidating for beginners. However, with the right approach, anyone can learn how to invest wisely in cryptocurrencies. This guide will walk you through the essential steps, from understanding the basics to making your first investment. Whether you want to buy Bitcoin, Ethereum, or explore newer altcoins, this article will help you get started safely and confidently. Let’s break down the process into simple, actionable steps.

Understanding Cryptocurrency Before Investing

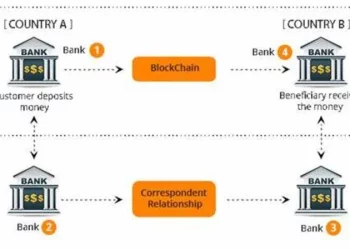

Before putting money into digital currencies, it’s important to understand what they are. Cryptocurrencies are digital assets that use blockchain technology to secure transactions. Unlike traditional money, they are decentralized, meaning no government or bank controls them. Bitcoin was the first cryptocurrency, but now there are thousands, each with different purposes. Some, like Ethereum, support smart contracts, while others focus on privacy or fast transactions. Learning the basics will help you make smarter investment choices.

Setting Clear Investment Goals

Ask yourself why you want to invest in cryptocurrency. Are you looking for long-term growth, short-term profits, or just learning about the technology? Your goals will influence which coins you buy and how long you hold them. Long-term investors might focus on established coins like Bitcoin and Ethereum. Short-term traders may look for volatile altcoins with quick price movements. Never invest money you can’t afford to lose, as the market can be unpredictable.

Choosing a Reliable Cryptocurrency Exchange

To buy digital currencies, you’ll need an account on a cryptocurrency exchange. Popular options include Coinbase, Binance, and Kraken. These platforms allow you to trade fiat money (like USD or EUR) for crypto. When choosing an exchange, consider fees, security features, and supported coins. Some exchanges are beginner-friendly with simple interfaces, while others offer advanced trading tools. Always enable two-factor authentication (2FA) to protect your account from hackers.

Securing Your Investments with a Wallet

After buying cryptocurrency, you should store it securely. While exchanges offer built-in wallets, they can be vulnerable to hacking. For better security, transfer your coins to a private wallet. Hardware wallets like Ledger and Trezor are the safest options because they store crypto offline. Software wallets, such as Exodus or Trust Wallet, are free and easy to use but slightly less secure. Never share your private keys—they give full access to your funds.

Starting with Small Investments

If you’re new to crypto, start with a small amount of money. This reduces risk while you learn how the market works. Many experts recommend investing only what you can afford to lose, especially in volatile assets. Dollar-cost averaging (DCA) is a smart strategy—instead of buying all at once, invest fixed amounts regularly. This helps average out price fluctuations over time.

Learning About Different Cryptocurrencies

Not all digital currencies are the same. Bitcoin is the most well-known, but others like Ethereum, Solana, and Cardano have unique features. Research each coin’s purpose, technology, and development team before investing. Avoid putting all your money into one coin—diversification lowers risk. Meme coins like Dogecoin can be tempting due to hype, but they are highly speculative and risky.

Understanding Market Trends and Analysis

Cryptocurrency prices change rapidly based on news, regulations, and market demand. Learning basic technical analysis can help you spot trends. Websites like CoinMarketCap and TradingView provide price charts and market data. Follow trusted crypto news sources to stay updated on major events. Avoid making decisions based on social media hype—always verify information before acting.

Managing Risks in Crypto Investing

Cryptocurrency investments come with risks, including price volatility, scams, and regulatory changes. Never invest in projects that promise unrealistic returns—these are often scams. Be cautious of phishing attacks and fake websites. Using stop-loss orders can limit losses if prices drop suddenly. Diversifying your portfolio across different coins and investment strategies helps spread risk.

Exploring Advanced Strategies Over Time

Once you’re comfortable with basic investing, you can explore more advanced strategies. Staking allows you to earn passive income by locking up certain coins. Yield farming in decentralized finance (DeFi) platforms can generate higher returns but carries more risk. Trading futures or margin trading can amplify profits but also losses. Only try these strategies after gaining experience.

Keeping Track of Taxes and Regulations

Many countries tax cryptocurrency profits, so keep records of all transactions. Use tools like CoinTracker or Koinly to generate tax reports. Regulations vary by country—some ban crypto trading, while others embrace it. Stay informed about legal changes in your region to avoid penalties.

Staying Patient and Avoiding Emotional Decisions

The crypto market can be stressful, with prices swinging dramatically. Avoid panic selling during dips or buying at all-time highs out of fear of missing out (FOMO). Stick to your investment plan and adjust only based on research, not emotions. Long-term investors often see better results than those who chase short-term gains.

Conclusion

Investing in digital currency can be rewarding but requires caution and education. Start small, prioritize security, and continuously learn about the market. Over time, you’ll gain confidence and make more informed decisions. Cryptocurrency is still a young and evolving space—those who approach it wisely have the best chance of success.

Related Topics:

What Countries Are Moving Toward Digital Currency