In the ever – evolving landscape of digital currencies, the idea of a government – issued digital currency, such as Fedcoin (a hypothetical digital currency issued by the Federal Reserve in the United States), has been a topic of significant discussion and speculation. While as of now, there is no official Fedcoin in circulation, understanding the theoretical process of how one might buy it can provide valuable insights into the world of digital currencies, central bank digital currencies (CBDCs), and the future of finance. This article will explore the various aspects related to the potential purchase of Fedcoin, from its underlying concepts to the possible steps and considerations.

Understanding Fedcoin

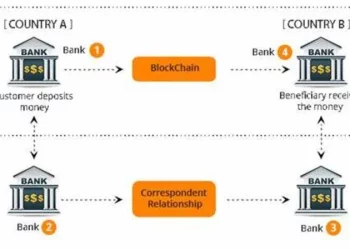

Fedcoin, in theory, would be a digital currency issued and regulated by the central bank, in this case, the Federal Reserve. Unlike cryptocurrencies like Bitcoin, which operate on decentralized blockchain networks, Fedcoin would likely have a more centralized structure. The Federal Reserve’s role in issuing Fedcoin would be to maintain monetary stability, regulate the money supply, and enhance the efficiency of the financial system.

One of the key features of Fedcoin would be its direct link to the national currency, the US dollar. It would be a digital representation of the existing fiat currency, which means its value would be pegged to the dollar. This would provide users with a sense of stability, as the value fluctuations would be less volatile compared to many other cryptocurrencies. Additionally, the issuance and management of Fedcoin would be under the strict control of the Federal Reserve, ensuring compliance with financial regulations and reducing the risks associated with illegal activities such as money laundering and fraud.

The Need for a Central Bank Digital Currency

The concept of a central bank digital currency like Fedcoin has emerged in response to several factors. First, the increasing popularity of digital payments and the rise of cryptocurrencies have shown that there is a demand for digital forms of money. By introducing a CBDC, central banks can offer a more secure, efficient, and regulated alternative to existing digital payment methods and cryptocurrencies.

Second, a CBDC can enhance financial inclusion. In many countries, there are still a significant number of unbanked or underbanked individuals who do not have access to traditional banking services. A digital currency issued by the central bank could potentially reach these individuals through mobile devices, allowing them to participate in the digital economy and access financial services more easily.

Finally, a CBDC can provide central banks with more effective tools for monetary policy implementation. With a digital currency, central banks can have a more detailed understanding of the flow of money in the economy, which can help them make more informed decisions regarding interest rates, money supply, and economic stimulus.

The Hypothetical Process of Buying Fedcoin

1. Eligibility and Registration

If Fedcoin were to be introduced, the first step for potential buyers would be to determine their eligibility. The Federal Reserve would likely set specific criteria for who can participate in the Fedcoin ecosystem. This could include being a citizen or legal resident of the United States, having a valid identification document, and meeting certain financial requirements.

Once eligibility is established, users would need to register with an authorized platform or institution. This could be a government – approved digital wallet provider or a financial institution that has partnered with the Federal Reserve. The registration process would involve providing personal information, such as name, address, social security number, and contact details. The institution would also verify the user’s identity through a series of security checks, including document verification and potentially biometric authentication.

2. Funding Your Digital Wallet

After successfully registering, users would need to fund their digital wallets with traditional US dollars. This could be done through various methods, similar to how one funds an online payment account or a cryptocurrency wallet. One option would be to link a bank account to the digital wallet and transfer funds directly. This could be achieved through an automated clearing house (ACH) transfer, which is a common method for electronic fund transfers in the United States.

Another option could be to use a debit or credit card to load funds into the wallet. However, there may be limitations and fees associated with using credit cards for digital currency purchases, as credit card companies and regulatory authorities may have concerns about the risks involved. Additionally, users might be able to deposit cash at specific physical locations, such as banks or authorized retailers, which would then be converted into Fedcoin and added to their digital wallets.

3. Buying Fedcoin

Once the digital wallet is funded, users would be able to buy Fedcoin. The process would likely involve navigating to a dedicated section within the digital wallet application or website and selecting the option to purchase Fedcoin. Users would need to specify the amount of Fedcoin they wish to buy, and the system would calculate the equivalent amount in US dollars based on the current exchange rate.

The exchange rate for Fedcoin would be determined and regulated by the Federal Reserve. It could be a fixed rate, similar to how the exchange rate is set for some traditional currencies in a pegged exchange rate system, or it could be a floating rate that is adjusted based on market conditions and the central bank’s monetary policy objectives.

After confirming the purchase, the system would deduct the appropriate amount of US dollars from the user’s digital wallet and credit the corresponding amount of Fedcoin to the wallet. The entire process would be secured using encryption and other security measures to protect the user’s funds and personal information.

4. Storage and Management

Once users own Fedcoin, they would need to manage and store it securely. The digital wallet provided by the authorized institution would serve as the primary storage facility for Fedcoin. It would have features similar to other digital wallets, such as the ability to view the balance, transaction history, and send and receive Fedcoin.

Users would also need to take precautions to protect their digital wallets. This could include setting up strong passwords, enabling two – factor authentication, and keeping their devices (such as smartphones or computers) updated with the latest security patches. Additionally, users should be aware of the risks associated with phishing attacks and other forms of cyber threats and take steps to avoid falling victim to them.

5. Selling and Withdrawing Fedcoin

If users decide to sell their Fedcoin and convert it back into US dollars, the process would be the reverse of the buying process. They would select the option to sell Fedcoin within their digital wallet, specify the amount they want to sell, and the system would convert it back into US dollars at the current exchange rate. The funds would then be credited back to the user’s linked bank account or made available for withdrawal in other approved forms.

Withdrawing Fedcoin in physical form, such as in the form of digital tokens on a hardware device, is less likely in the case of a central bank – issued digital currency like Fedcoin. However, if the Federal Reserve were to introduce such a feature, users would need to follow specific procedures to transfer their Fedcoin to a compatible hardware wallet or other storage device.

Regulatory and Security Considerations

When it comes to buying Fedcoin, regulatory and security aspects would play a crucial role. The Federal Reserve, as the issuer of Fedcoin, would implement strict regulations to ensure the stability and integrity of the financial system. These regulations would cover areas such as anti – money laundering (AML) and know – your – customer (KYC) requirements.

Financial institutions and digital wallet providers involved in the Fedcoin ecosystem would be required to comply with these regulations. They would need to monitor transactions, report suspicious activities, and verify the identities of their customers. This would help prevent illegal activities and protect the overall financial system from potential risks.

From a security perspective, the Fedcoin ecosystem would need to be highly secure to protect users’ funds and personal information. The digital wallets and the underlying infrastructure would be protected using advanced encryption techniques, firewalls, and other security measures. Regular security audits and updates would be carried out to identify and address any potential vulnerabilities.

Challenges and Controversies

The introduction of Fedcoin and the process of buying it would not be without challenges and controversies. One of the main concerns is related to privacy. Since the Federal Reserve and financial institutions would have access to detailed transaction data, there are concerns about how this data would be used and protected. Some individuals may be reluctant to use Fedcoin if they feel that their privacy is being compromised.

Another challenge is the potential impact on the existing banking system. Commercial banks play a crucial role in the economy by providing loans, accepting deposits, and facilitating financial transactions. The introduction of a central bank digital currency could potentially disrupt the traditional banking model, as some customers may choose to hold their funds directly in the form of Fedcoin instead of in bank accounts. This could lead to a reduction in bank deposits and potentially affect the availability of credit in the economy.

There are also technical challenges associated with the implementation of a central bank digital currency. Ensuring the scalability, security, and efficiency of the Fedcoin system would require significant technological investment and development. Additionally, interoperability with existing payment systems and financial infrastructure would need to be carefully considered to ensure a seamless transition.

Conclusion

In conclusion, while Fedcoin currently remains a hypothetical digital currency, understanding the potential process of how to buy it provides valuable insights into the future of digital currencies and central bank digital currencies. The concept of Fedcoin offers the promise of a more stable, secure, and regulated digital form of money, but it also comes with a host of challenges and considerations.

The process of buying Fedcoin would likely involve eligibility determination, registration, funding the digital wallet, purchasing the currency, and managing its storage. Regulatory and security aspects would be of utmost importance to safeguard the financial system and users’ interests. However, issues related to privacy, the impact on the banking system, and technical challenges would need to be addressed before the successful implementation of a central bank digital currency like Fedcoin. As the financial landscape continues to evolve, the possibility of a government – issued digital currency becoming a reality remains an area of ongoing research and discussion.

Related topic: