Cryptocurrency mining has emerged as a lucrative activity, drawing interest from individuals and businesses alike. However, alongside the potential profits from mining, there comes a complex set of tax obligations that must be understood and managed. This article delves into how mined cryptocurrency is taxed, exploring the regulatory landscape, the process of tax calculation, and strategies for compliance.

Tax Treatment of Mined Cryptocurrency

Regulatory Landscape

The regulatory treatment of mined cryptocurrency varies significantly across jurisdictions. However, the general principle is that mined cryptocurrency is treated as income at the point of receipt. This means that the fair market value of the mined cryptocurrency at the time it is successfully mined is subject to income tax.

United States

In the United States, the Internal Revenue Service (IRS) has provided clear guidelines on the taxation of cryptocurrency mining. According to the IRS, mined cryptocurrency is considered income and is subject to income tax upon receipt. The fair market value of the mined cryptocurrency at the time of receipt must be reported as income.

European Union

In the European Union, the tax treatment of mined cryptocurrency can differ between member states. However, there is a general trend towards treating mined cryptocurrency as income, similar to the approach in the United States. Member states may have additional reporting requirements and tax obligations that miners must adhere to.

Other Jurisdictions

Other jurisdictions around the world have varying approaches to the taxation of mined cryptocurrency. Some countries have comprehensive regulations, while others are still developing their frameworks. It is crucial for miners to stay informed about the tax regulations in their specific jurisdiction to ensure compliance.

Income Tax on Mined Cryptocurrency

Determining Fair Market Value

The first step in calculating the tax on mined cryptocurrency is to determine its fair market value at the time of receipt. The fair market value is typically established using the exchange rate on the date the cryptocurrency is mined. Miners can use the rate from a reputable cryptocurrency exchange to determine this value.

Income Reporting

Once the fair market value is determined, the mined cryptocurrency must be reported as income. This is typically done on the individual’s or business’s tax return. The amount reported is the fair market value of the mined cryptocurrency at the time of receipt.

Example Calculation

Suppose a miner successfully mines 1 Bitcoin (BTC) on January 1, 2023. On this date, the fair market value of 1 BTC is $30,000. The miner must report $30,000 as income on their tax return for the 2023 tax year.

Self-Employment Tax

United States Perspective

In the United States, mined cryptocurrency is also subject to self-employment tax if the mining activity constitutes a trade or business. Self-employment tax covers Social Security and Medicare taxes for individuals who work for themselves.

Determining Trade or Business

Whether mining constitutes a trade or business depends on various factors, including the frequency and substantiality of the mining activity. If mining is carried out with continuity and regularity, it is likely to be considered a trade or business, subjecting the miner to self-employment tax.

Example Calculation

Continuing with the previous example, if the miner operates their mining activities as a business, they must also pay self-employment tax on the $30,000 income. The self-employment tax rate is 15.3%, which includes both the employer and employee portions of Social Security and Medicare taxes.

Capital Gains Tax

Overview

In addition to income tax, mined cryptocurrency may also be subject to capital gains tax when it is disposed of. Disposal can occur through selling, exchanging, or using the cryptocurrency to purchase goods or services.

Basis Calculation

The basis of the mined cryptocurrency is its fair market value at the time of receipt. When the cryptocurrency is disposed of, the capital gain or loss is calculated as the difference between the disposal price and the basis.

Short-Term vs. Long-Term Gains

Capital gains tax rates can vary depending on the holding period of the cryptocurrency. In many jurisdictions, including the United States, different rates apply to short-term and long-term capital gains. Short-term gains (cryptocurrency held for one year or less) are typically taxed at higher rates than long-term gains (cryptocurrency held for more than one year).

Example Calculation

Suppose the miner from the previous examples sells their 1 BTC on June 1, 2023, for $40,000. The basis of the BTC is $30,000 (its fair market value when mined). The capital gain is $10,000 ($40,000 – $30,000). If the BTC was held for less than one year, the gain is considered short-term and taxed at ordinary income tax rates. If held for more than one year, the gain is considered long-term and taxed at the long-term capital gains rate.

Tax Deductibility of Mining Expenses

Business Expenses

If mining activities constitute a trade or business, miners may be able to deduct ordinary and necessary business expenses from their income. These expenses can include electricity, hardware, software, and other costs directly associated with mining activities.

Hobby vs. Business

It is important to distinguish between hobby and business activities. If mining is considered a hobby rather than a business, expense deductions may be limited. Hobby expenses can generally only be deducted up to the amount of hobby income.

Record-Keeping

Proper record-keeping is essential for claiming deductions. Miners should maintain detailed records of all expenses related to their mining activities, including receipts, invoices, and logs of electricity usage.

Example Calculation

Suppose the miner has $5,000 in deductible business expenses related to their mining activities. These expenses can be deducted from the $30,000 income, resulting in a net income of $25,000. The miner will then report $25,000 as taxable income on their tax return.

International Considerations

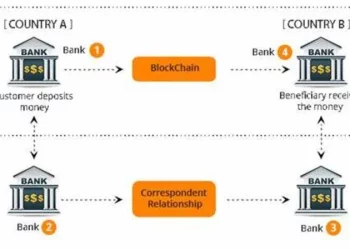

Cross-Border Mining

Cross-border mining activities can introduce additional tax complexities. For example, if a miner operates in multiple countries, they may be subject to tax obligations in each jurisdiction. Double taxation agreements (DTAs) between countries may help mitigate the risk of being taxed on the same income by multiple jurisdictions.

Foreign Account Reporting

In some cases, miners may be required to report foreign accounts and transactions. For example, U.S. taxpayers must comply with the Foreign Account Tax Compliance Act (FATCA) and Report of Foreign Bank and Financial Accounts (FBAR) requirements if they have foreign financial accounts exceeding certain thresholds.

Example Scenario

A U.S.-based miner operates mining equipment in Canada. The miner may be subject to Canadian income tax on the mining income generated in Canada. The miner can claim a foreign tax credit on their U.S. tax return for taxes paid to Canada, reducing the risk of double taxation.

Tax Planning Strategies

Timing of Disposal

Strategic timing of cryptocurrency disposal can help minimize capital gains tax liability. For example, holding cryptocurrency for more than one year can qualify for lower long-term capital gains tax rates.

Expense Optimization

Careful management of mining expenses can maximize deductible business expenses, reducing taxable income. Miners should consider the timing and necessity of expenses to optimize tax benefits.

Professional Advice

Given the complexities of cryptocurrency taxation, seeking professional tax advice is highly recommended. Tax professionals can provide tailored guidance based on individual circumstances and help ensure compliance with tax regulations.

See also: Is Crypto Mining Legal in China?

Conclusion

Cryptocurrency mining presents significant opportunities for income generation, but it also brings complex tax obligations. Understanding the tax treatment of mined cryptocurrency, including income tax, self-employment tax, and capital gains tax, is essential for miners to remain compliant and optimize their tax liability.

Proper record-keeping, strategic planning, and seeking professional advice are crucial steps in managing the tax implications of cryptocurrency mining. As regulatory frameworks continue to evolve, staying informed about changes in tax regulations is vital for all cryptocurrency miners. By navigating the intricacies of cryptocurrency taxation, miners can focus on their mining activities while ensuring they meet their tax obligations.

Related topics:

Is Crypto Mining Legal in the USA?