In the ever – expanding universe of digital currencies, Scotcoin has emerged as an option that has piqued the interest of some investors and enthusiasts. Buying Scotcoin, like any other cryptocurrency, involves a series of steps that require careful consideration, research, and adherence to certain procedures. This article will take you through the entire process, from understanding the basics of Scotcoin to safely purchasing and storing it, ensuring that you can make informed decisions if you choose to engage with this digital asset.

Understanding Scotcoin

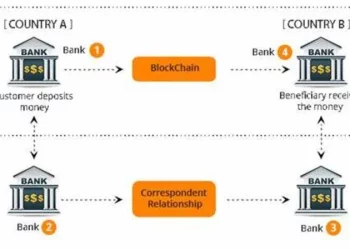

Before diving into the purchasing process, it’s crucial to have a clear understanding of what Scotcoin is. Scotcoin is a digital currency that operates on blockchain technology, a decentralized and distributed ledger system. The blockchain serves as the foundation for all Scotcoin transactions, recording every transfer of the currency from one wallet to another in a secure and transparent manner.

One of the key features of Scotcoin is its potential for peer – to – peer transactions. This means that users can send and receive Scotcoin directly to and from each other without the need for intermediaries like banks. This can lead to faster transaction times and potentially lower fees compared to traditional financial systems. Additionally, Scotcoin’s digital nature allows for easy transfer across geographical boundaries, making it an attractive option for international transactions.

However, it’s important to note that the value of Scotcoin, like all cryptocurrencies, is highly volatile. Its price can fluctuate significantly within short periods, influenced by factors such as market demand, regulatory changes, technological advancements, and overall sentiment in the cryptocurrency market. Understanding these characteristics is essential as they will impact your investment decisions and the overall experience of buying and holding Scotcoin.

Researching and Selecting a Cryptocurrency Exchange

The first practical step in buying Scotcoin is choosing a suitable cryptocurrency exchange. There are several factors to consider when making this selection.

Reputation and Security

A reputable exchange is one that has a history of reliable service and a good standing within the cryptocurrency community. Look for exchanges that have been operating for a significant period and have positive reviews from users. Security is of utmost importance when dealing with cryptocurrency exchanges, as they hold your funds and personal information. Exchanges should implement robust security measures, such as two – factor authentication (2FA), cold storage for the majority of customer funds (keeping the funds offline and away from potential hackers), and regular security audits.

Scotcoin Availability

Not all cryptocurrency exchanges list Scotcoin for trading. You need to specifically search for exchanges that support Scotcoin. You can do this by checking cryptocurrency listing websites, Scotcoin’s official website, or relevant cryptocurrency forums and communities. Once you’ve identified potential exchanges, ensure that they offer the trading pairs you need. For example, if you plan to buy Scotcoin using fiat currency like the British Pound, make sure the exchange has a Scotcoin/GBP trading pair available.

Fees and Charges

Exchanges charge various fees for their services, and these can significantly impact your overall cost of buying Scotcoin. Trading fees are typically charged as a percentage of the transaction value. Some exchanges may also have deposit and withdrawal fees, which can vary depending on the payment method and the currency used. Compare the fee structures of different exchanges to find one that offers competitive rates. Additionally, be aware of any hidden fees or charges that could surprise you later.

Regulatory Compliance

In many regions, cryptocurrency exchanges are required to comply with certain financial regulations to protect consumers and prevent illegal activities such as money laundering and fraud. Choose an exchange that is licensed and regulated by relevant authorities in your jurisdiction or in well – regulated countries. This ensures that the exchange operates within a legal framework and provides you with some level of protection in case of any disputes or issues.

Opening an Account on the Exchange

Once you’ve selected an exchange that meets your requirements, the next step is to open an account.

Registration

Visit the exchange’s website and look for the “Sign Up” or “Register” button. You’ll be asked to provide basic information such as your email address, create a password, and in some cases, enter your phone number. Make sure to choose a strong password that combines uppercase and lowercase letters, numbers, and special characters to enhance the security of your account.

Verification

Most regulated exchanges require identity verification to comply with anti – money laundering (AML) and know – your – customer (KYC) regulations. You’ll need to upload documents such as a government – issued ID (like a passport or driver’s license), proof of address (such as a utility bill or bank statement), and sometimes a selfie holding your ID. The verification process can take anywhere from a few hours to several days, depending on the exchange’s internal procedures and the volume of verification requests they receive.

Funding Your Account

After your account is verified, you need to fund it with the currency you plan to use to buy Scotcoin. This could be fiat currency (e.g., through bank transfer, credit/debit card payment) or another cryptocurrency if the exchange supports such deposits. Bank transfers are a common method but may take a few business days to process. Credit/debit card payments are usually faster but may incur higher fees, and some card issuers may restrict cryptocurrency – related transactions. If you’re depositing another cryptocurrency, you’ll need to transfer it from your existing wallet to the exchange’s wallet address, which you can find in the deposit section of your account on the exchange.

Placing an Order to Buy Scotcoin

With your account funded, you’re ready to place an order to buy Scotcoin. There are two main types of orders you can place on a cryptocurrency exchange:

Market Order

A market order is an order to buy Scotcoin at the current market price. This is the quickest way to execute a trade. When you place a market order, the exchange will immediately match your order with the best available sell orders in the market. However, the price you pay may not be exactly the same as the price you saw when you initiated the order, especially in a volatile market. This is because the market price can change rapidly between the time you click “buy” and the time the order is filled.

Limit Order

A limit order allows you to set the price at which you want to buy Scotcoin. You specify the maximum price you’re willing to pay, and the order will only be executed if the market price drops to or below that level. For example, if the current market price of Scotcoin is £5, but you believe it will drop to £4.50, you can place a limit order with a buy price of £4.50. This gives you more control over the price at which you enter the market but means that your order may not be filled if the market price doesn’t reach your specified level.

Storing Your Scotcoin

Once you’ve successfully purchased Scotcoin, it’s essential to store it securely. While the exchange where you bought the Scotcoin provides a wallet for you to hold your funds, it’s generally recommended to transfer your Scotcoin to a personal wallet for added security.

Types of Wallets

Hardware Wallets: These are physical devices that store your private keys offline. They are considered one of the most secure types of wallets as they are immune to online threats such as hacking and malware. Popular hardware wallets include Ledger and Trezor. You can connect the hardware wallet to your computer or mobile device when you want to make a transaction, ensuring that your private keys are only exposed in a secure, controlled environment.

Software Wallets: Software wallets are applications that you can install on your computer or mobile device. They can be either hot wallets (connected to the internet) or cold wallets (used offline). Hot wallets are convenient for making quick transactions but are more vulnerable to online attacks. Cold software wallets offer a higher level of security as they keep your private keys offline until you need to use them.

Paper Wallets: A paper wallet is a physical document that contains your public and private keys. You can generate a paper wallet using a wallet generator tool. While paper wallets are very secure when stored properly, they can be lost, damaged, or stolen. If you choose to use a paper wallet, it’s crucial to store it in a safe place, such as a fireproof and waterproof safe.

Transferring Scotcoin to Your Wallet

To transfer your Scotcoin from the exchange to your personal wallet, you first need to obtain the wallet address of your personal wallet. In your personal wallet application or device, there will be a section where you can view the wallet address for Scotcoin. Copy this address and go to the withdrawal section on the exchange. Paste the address, enter the amount of Scotcoin you want to withdraw, and confirm the transaction. The exchange may charge a withdrawal fee for this service, so make sure to check the fee amount before finalizing the transfer.

Monitoring and Managing Your Scotcoin Investment

Buying Scotcoin is just the beginning of your investment journey. To make the most of your investment and manage the associated risks, it’s important to monitor and manage your Scotcoin holdings.

Keeping Up with Market News

Stay informed about the latest news and developments related to Scotcoin and the broader cryptocurrency market. This includes regulatory changes, technological updates to the Scotcoin blockchain, and any announcements from the Scotcoin development team. You can follow reliable cryptocurrency news websites, join Scotcoin – specific forums and social media groups, and subscribe to newsletters to stay updated. Changes in these areas can have a significant impact on the value of Scotcoin, and being informed will help you make better – informed decisions about your investment.

Analyzing Market Trends

Use technical and fundamental analysis to understand market trends. Technical analysis involves studying price charts, trading volumes, and various technical indicators to predict future price movements. Fundamental analysis focuses on factors such as the overall health of the Scotcoin ecosystem, the team behind its development, and its real – world use cases. By analyzing market trends, you can identify potential buying and selling opportunities and adjust your investment strategy accordingly.

Portfolio Diversification

It’s not advisable to put all your investment eggs in one basket. Consider diversifying your investment portfolio by including other cryptocurrencies or traditional assets. This can help reduce your overall risk, as different assets may perform differently under various market conditions. For example, if the value of Scotcoin drops, other assets in your portfolio may remain stable or even increase in value, offsetting some of the losses.

Conclusion

Buying Scotcoin involves a series of well – defined steps, from understanding the nature of the digital currency to safely storing and managing your investment. By carefully researching and selecting a reliable cryptocurrency exchange, following the proper account – opening and verification procedures, placing informed orders, and taking appropriate security measures for storage, you can enter the world of Scotcoin investment in a responsible and secure manner. However, it’s important to remember that the cryptocurrency market, including Scotcoin, is highly volatile and risky. Only invest money that you can afford to lose, and always stay informed and vigilant to make the best decisions for your financial situation.

Related topic: